Buyers Agent Adelaide: Investment Property Specialists

Looking for a buyers agent in Adelaide who specialises exclusively in investment property? We’re based in Sydney but buy quality investment properties across Adelaide and regional South Australia every month. Zero conflicts of interest. No developer commissions. Just data-driven property selection focussed on cash flow and capital growth.

Leave it to the Experts

Why Use a Buyers Agent in Adelaide for Investment Property?

Adelaide’s property market has become increasingly attractive to investors over the past 5 years. With median house prices around $750,000-$800,000 – significantly lower than Sydney and Melbourne – and rental yields typically between 4.5% and 6.5%, Adelaide offers genuine cash flow opportunities.

But here’s the challenge: if you’re investing from interstate, you’re competing against local buyers who know every suburb, every pocket, and every decent agent. You’re making decisions based on online research and weekend flying visits. That’s where an experienced Adelaide buyers agent makes the difference.

We’re not Adelaide-based, but we buy investment properties across Adelaide regularly. We’ve built relationships with agents throughout the metro area and regional SA. We access off-market properties before they hit realestate.com.au. We analyse every purchase through an investor lens – rental demand, infrastructure projects, employment growth, and realistic capital growth projections.

Most importantly, we have zero conflicts of interest. We don’t accept developer commissions. We don’t get rebates from builders. We don’t sell house and land packages. Our only income is the transparent flat fee you pay us – typically $8,000 to $16,000+ depending on property price and complexity.

Investment Property Markets We Cover in Adelaide & Regional SA

As an Adelaide buyers advocate, we focus on suburbs and towns with genuine investor fundamentals. We’re not chasing hot tips or speculative plays. We’re looking for areas with employment growth, infrastructure investment, rental demand, and realistic pathways to capital growth over 7-10 years.

Northern Adelaide Growth Corridors

The northern suburbs have seen significant development and infrastructure investment. Areas like Munno Para, Angle Vale, Gawler, and Elizabeth offer entry-level investment opportunities with rental yields often exceeding 5.5%. The electrification of the Gawler rail line has improved connectivity to the CBD, making these suburbs increasingly viable for renters commuting to Adelaide.

Southern Adelaide Coastal & Growth Areas

The southern corridor from Morphett Vale through Aldinga and McLaren Vale combines lifestyle appeal with affordability. These areas attract young families and sea-changers, providing solid rental demand. Median house prices typically range from $550,000 to $700,000, with rental yields around 4.5% to 5.5%.

Western Suburbs

Suburbs like Findon, Woodville, Seaton, and West Lakes offer proximity to the CBD (6-12km) at more affordable price points than eastern suburbs. These established areas provide consistent rental demand from workers in nearby industrial and commercial hubs.

Emerging Eastern Growth

While traditionally more expensive, pockets in the east like Dernancourt, Rostrevor (lower end), and Tea Tree Gully can offer investment opportunities, particularly for higher-income tenants seeking good schools and established amenities.

What Makes Australian Property Experts Different as Adelaide Buyers Agents?

100% Investment Property Focus

We don't help people buy homes to live in. We only work with property investors. This means every property we evaluate is analysed purely through an investment lens – cash flow, capital growth potential, rental demand, and portfolio strategy.

Zero Conflicts of Interest

We never accept commissions from developers, builders, or anyone selling property. No rebates. No kickbacks. No hidden incentives. You pay us a transparent flat fee, and we work exclusively in your interests.

Off-Market Property Access

Through our agent network across Adelaide and regional SA, we access properties before they're publicly listed. This gives you first look at opportunities without competing against dozens of other buyers online.

Data-Driven Strategy

Peter's background as a banker and financial analyst means every purchase is backed by detailed financial modelling. We analyse rental yields, cash flow projections, comparable sales, suburb growth trends, and risk factors before recommending any property.

Experience That Matters

Peter personally owns 16+ investment properties and has purchased 200+ properties for clients across Australia. This isn't theoretical knowledge – it's practical experience from someone who invests his own money using the same strategies.

Australia-Wide Buying

We're not limited to Adelaide. If a better investment opportunity exists in Brisbane, Perth, or regional NSW, we'll tell you. Our goal is finding the right investment property for your strategy, wherever that might be.

Our Adelaide Buyers Agency Process

Here’s exactly how we work with investors looking to buy investment property in Adelaide or regional South Australia:

Discovery Call (Free)

We start with a no-obligation discovery call to understand your investment goals, budget, borrowing capacity, timeframe, and risk tolerance. We'll discuss whether Adelaide fits your strategy or if another market makes more sense. This call typically takes 30-45 minutes.

Strategy Session & Market Analysis

If Adelaide is the right market for you, we'll provide detailed analysis of suburbs that match your criteria. We'll discuss realistic rental yields, capital growth expectations, tenant demographics, and any risks we see. This isn't a sales pitch – it's honest market analysis.

Property Search & Off-Market Access

We activate our Adelaide agent network and begin searching both on-market and off-market properties. Most of our clients secure properties off-market, avoiding the competitive pressure of public listings. We typically present 2-5 properties that meet your criteria.

Due Diligence & Financial Analysis

For each property we recommend, we provide comprehensive due diligence: comparable sales analysis, rental appraisal, strata review (if applicable), pest and building inspection coordination, council checks, and cash flow modelling. You see exactly what you're buying and what returns to expect.

Negotiation & Acquisition

We handle all negotiation with the selling agent. Our goal is securing the property at the best possible price – typically $20,000 to $50,000 below asking price depending on market conditions. We manage offers, counteroffers, and contract terms on your behalf.

Settlement & Handover

We coordinate with your solicitor, mortgage broker, and property manager to ensure smooth settlement. Once settled, we can introduce you to trusted property managers in Adelaide who specialise in investor properties. Typical timeframe from offer to settlement is 6-8 weeks.

Who Uses Our Adelaide Buyers Agent Service?

Our clients come from all over Australia and overseas. What they have in common is a serious approach to property investment and the recognition that professional help delivers better outcomes. Here are the typical investors we work with:

Time-Poor Professionals

Doctors, engineers, executives, and business owners who understand the value of investment property but don't have time to research suburbs, attend inspections, and negotiate deals. They're focussed on their careers and want property investment handled professionally.

First-Time Investors

People buying their first investment property who want to avoid expensive mistakes. They're often overwhelmed by the options and need expert guidance to make a smart first purchase that sets up their portfolio correctly.

Experienced Portfolio Builders

Investors with 3-10+ properties who want to expand into Adelaide or regional SA. They understand the market and recognise that local expertise and off-market access provide competitive advantages.

Interstate & Overseas Investors

Buyers living in Sydney, Melbourne, Brisbane, Perth, or overseas who want to invest in Adelaide but can't physically attend inspections or meet agents. We become their eyes, ears, and local expertise.

SMSF & Trust Buyers

Investors purchasing through Self-Managed Super Funds, family trusts, or company structures. These purchases require additional due diligence and coordination with accountants and solicitors – we handle the property side of these complex transactions.

Renovation & Development Investors

Experienced investors looking for properties with value-add potential through renovation, subdivision, or small-scale development. We identify properties with the right zoning, land size, and renovation scope to create additional equity.

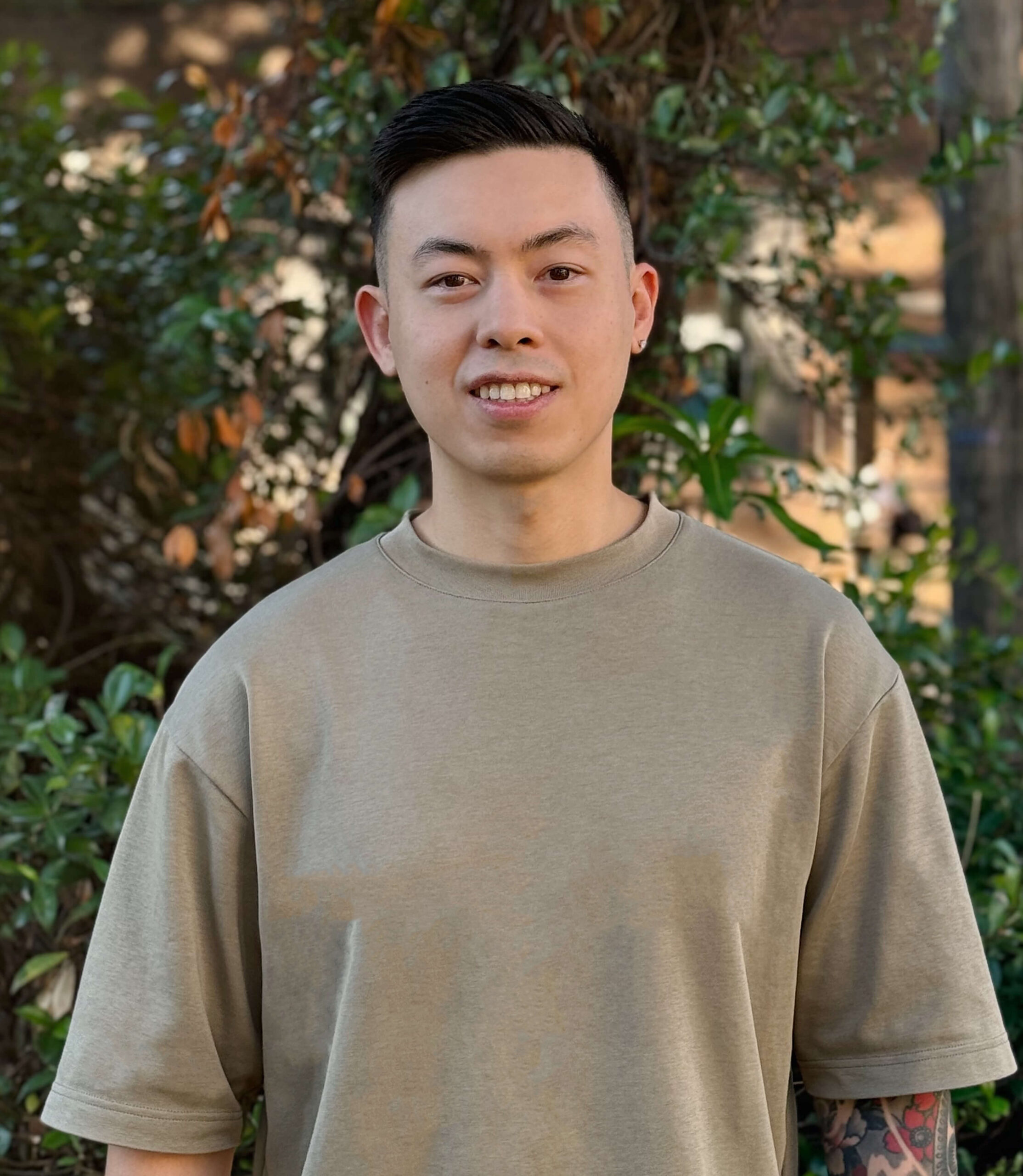

Meet Peter Ly – Your Adelaide Property Investment Specialist

I’m Peter Ly, founder of Australian Property Experts. I’m a licensed buyers agent (License No. 4769472) based in Parramatta, Sydney, but I buy investment properties across Adelaide and throughout Australia for my clients.

I personally own 16+ investment properties across multiple states, and I’ve purchased over 200 properties for clients since starting this buyers agency. Before becoming a buyers agent, I spent years as a banker and financial analyst, which gave me a strong foundation in property analysis and investment modelling.

I started buying investment properties in my early 20s while working in banking. I made mistakes, learned lessons, and gradually built a portfolio that generates substantial passive income. That hands-on experience – both the wins and the losses – taught me what works and what doesn’t in property investment Adelaide.

When I started helping friends and colleagues buy investment properties, I realised most buyers agents had conflicts of interest. They accepted commissions from developers. They pushed house and land packages that paid them fat rebates. They prioritised their income over their clients’ outcomes.

I built Australian Property Experts differently. We have zero conflicts of interest. We don’t accept any money from developers, builders, or selling agents. We charge a transparent flat fee, and we work exclusively for you. It’s a simple business model, but it’s the right one.

My accounting background means I approach every property purchase with detailed financial analysis. We model cash flow, calculate realistic returns, and assess risk factors. We’re not in the business of selling dreams – we’re in the business of building profitable property portfolios.

If you’re considering buying investment property in Adelaide or anywhere else in Australia, book a discovery call. I’ll give you straight answers about whether Adelaide is right for your strategy, and whether we’re the right buyers agent for you.

Ready to Buy Your Next Investment Property in Adelaide?

If you’re serious about buying investment property in Adelaide or regional South Australia, we should talk. Here’s what happens next:

Book a free discovery call using our Calendly link. This call typically takes 30-45 minutes. We’ll discuss your investment goals, budget, timeframe, and whether Adelaide fits your strategy.

No pressure, no obligation. If we’re not the right buyers agent for you, we’ll tell you. If Adelaide isn’t the right market for your goals, we’ll say so. We’re interested in long-term client relationships, not quick sales.

Get honest advice from someone who invests themselves. Peter owns 16+ investment properties and buys using the same strategies we recommend to clients. This isn’t theoretical knowledge – it’s practical experience from someone with skin in the game.

We work with investors at all levels: first-time buyers nervous about their first purchase, experienced portfolio builders expanding into new markets, time-poor professionals who want property investment Adelaide handled professionally, and interstate or overseas investors who need local expertise.

If you want off-market access, zero conflicts of interest, data-driven property selection, and experienced negotiation, we’re the Adelaide buyers agent for you.

Book a free discovery call with Peter to discuss your investment goals, or call directly on 0468 886 683 for immediate advice.

Our Results Speak for Themselves

Recent Deals

26.7% growth in 10 months (WA)

This 4 bed 1 bath double-brick house in WA boasts a rental yield of 8.1%. We purchased this one under market value for $355,000 in June 2023, and it has since seen an unbelievable 35.2% growth to $480,000 in just 10 months.

41.8% growth in 18 months (WA)

This beautiful house in Perth, less than 5 minutes to the beach, was purchased for $398,900 in June 2022. It has since seen 50.4% growth to $600,000 in 18 months and has seen its rental yield grow from 5.5% at purchase to now 7.2%.

35% growth in 21 months (QLD)

This brick Queensland house was purchased only 21 months ago for $422,000, and has since grown 37.4% to $580,000, resulting in capital growth of $158,000 and cash on cash return of 234%. Rent has also grown steadily and is now returning a strong rental yield of 6.28%.

27.2% growth in 14 months (QLD)

This regional Queensland house with strong rental yield of 6.27%, has grown a whopping $124,000 to $580,000 in just over one year since it was purchased for $456,000, resulting in an impressive cash on cash return of 170%.

76.7% growth in 26 months (WA)

We purchased this brick house in Perth on a massive 819sqm block of land, just 20km from the Perth CBD, for $339,500 back in February 2022. It has since seen remarkable growth of 76.7% growth to $600,000 in 26 months. Rental yield is now sitting at a jaw dropping 8.42%.

32.6% growth in 26 months (Adelaide)

This renovated brick house, 31km from Adelaide CBD and just minutes to the beach, was purchased in February 2022 for $460,000. In 26 months, it has grown 32.6% in value to $610,000, resulting in a cash on cash return of 204%. Rental yield is sitting at a solid 5.65%.

Book Your Free Strategy Call

Learn More

Frequently Asked Questions

Our buyers agent fee structure is transparent and based on property price and complexity. For most Adelaide purchases, our fee ranges from $8,000 to $16,000+. This is a flat fee, not a percentage.

We cover all of metropolitan Adelaide and regional South Australia. Our focus is on suburbs and towns with strong investment fundamentals – employment growth, infrastructure investment, rental demand, and realistic capital growth potential.

We only work with property investors buying investment property. We don’t help people buy homes to live in (owner-occupier properties).

This 100% investment focus means we analyse every property purely through an investor lens. We’re not considering emotional factors like whether the kitchen looks nice or if the backyard is perfect for kids. We’re assessing rental yield, capital growth potential, tenant demand, maintenance costs, and how the property fits your overall portfolio strategy.

If you’re looking to buy a home to live in Adelaide, we’re not the right buyers agent for you. But if you’re building a property portfolio and want expert help finding investment-grade properties, we should talk.

Absolutely. Most of our Adelaide clients are interstate or overseas investors who can’t physically attend inspections or meet agents. That’s exactly why they hire us.

We become your eyes, ears, and local expertise in Adelaide. We attend all inspections on your behalf, provide detailed video walkthroughs, coordinate building and pest inspections, handle all communication with agents, and manage the entire purchase process remotely.

Most of our Adelaide clients secure properties off-market. We can’t give you an exact percentage because it varies depending on the specific suburb, price point, and market conditions, but off-market deals make up the majority of our purchases.

Our off-market access comes from relationships with agents throughout Adelaide metro and regional SA. Agents call us first when they have investment-grade properties coming to market because they know we have qualified buyers ready to move quickly.

Off-market properties give you significant advantages: you’re not competing against dozens of buyers online, you avoid the pressure of multiple-offer scenarios, and you typically negotiate better prices because sellers prefer the certainty of a quick, clean sale.

That said, we also buy on-market properties when they represent good value. We’re not ideological about it – if the best investment opportunity is listed publicly, we’ll pursue it. But in most cases, off-market access delivers better outcomes for investors.

You should use a buyers agent if you want better properties, better prices, and less risk. It’s that simple.