Perth Buyers Agent for Investment Property

Leave it to the Experts

Looking for a Perth buyers agent who specialises exclusively in investment property?

We’re buyers advocates based in Sydney who buy properties across Perth and regional Western Australia for investors who want off-market deals, zero conflicts of interest, and data-driven strategies.

We don’t buy owner-occupier homes. We only work with property investors who want cash flow, capital growth, or both.

Book Your Free Perth Property Strategy Call

Perth’s property market has experienced significant transformation over the past few years. After a period of stagnation, median house prices have climbed from $530,000 in 2020 to over $800,000 in 2025, driven by interstate migration, mining sector strength, and chronic undersupply.

If you’re a time-poor professional, first-time investor, or experienced portfolio builder looking to capitalise on Perth’s growth, you need someone who understands investment property fundamentals—not just someone who can open doors and write contracts.

That’s where we come in. Peter Ly, founder of Australian Property Experts, has personally purchased 200+ investment properties for clients across Australia, including dozens in Perth and regional WA. With a background in banking, financial analysis, and accounting, Peter approaches every purchase with forensic-level due diligence and zero tolerance for conflicts of interest.

Why Use a Buyers Agent in Perth?

Perth’s property market looks straightforward on the surface, but scratch below and you’ll find complexities that can cost uninformed investors tens of thousands of dollars.

Here’s what most Perth property investors don’t realise:

Off-market properties are everywhere

Up to 30% of Perth transactions happen off-market or pre-market, meaning you'll never see them on realestate.com.au. A buyers advocate in Perth with an established agent network gets first access.

Not all suburbs are equal

Within 10km, you can have suburbs with 6% rental yields sitting next to suburbs with 3% yields. Location selection is everything for investment returns.

Mining cycles drive everything

Perth's economy is heavily tied to resources. Understanding where we are in the cycle prevents you from buying at the peak or selling at the trough.

Vendor advocacy is real

99% of real estate agent Perth represent sellers, not buyers. Their job is to get the highest price possible, which is the opposite of what you want as a buyer.

Interstate investors get stung

If you're buying from Sydney, Melbourne, or Brisbane, you're at a disadvantage. You don't know the streets, the agents, or the local market nuances. That's where an investment buyers agent in Perth adds massive value.

Using a property buyers agent in Perth isn’t about paying someone to do the legwork. It’s about leveraging expertise, networks, and negotiation skills to buy better properties for less money than you’d achieve on your own.

Investment Property Markets We Cover in Perth and WA

We buy investment property across Perth’s metropolitan area and regional Western Australia, focussing on suburbs and towns with strong fundamentals: employment diversity, infrastructure investment, population growth, and rental demand.

Perth North

Suburbs: Joondalup, Wanneroo, Yanchep, Alkimos, Eglinton, Butler

Perth’s northern corridor is one of the fastest-growing regions in Australia. Yanchep and Alkimos have seen population increases of 15-20% annually, driven by affordable land, new schools, shopping centres, and the extension of the Mitchell Freeway.

Typical rental yields: 4.5-5.5%

Perth South

Suburbs: Mandurah, Baldivis, Port Kennedy, Secret Harbour, Rockingham, Kwinana

The southern suburbs offer strong value for investors, particularly in Mandurah and Baldivis. These areas benefit from retiree migration, proximity to employment hubs like Kwinana industrial area, and improved transport links.

Typical rental yields: 4.0-5.0%

Perth East

Suburbs: Midland, Ellenbrook, The Vines, Aveley, Bassendean

Eastern suburbs like Ellenbrook and Aveley have experienced consistent growth due to master-planned community developments, improved rail connections, and strong family appeal. Midland’s revitalisation has also attracted investors.

Typical rental yields: 4.5-5.5%

Perth Inner Suburbs

Suburbs: Victoria Park, Maylands, Mount Lawley, Inglewood, Bedford, Bayswater

Inner-city suburbs offer lower yields (3.0-4.0%) but stronger capital growth potential due to gentrification, proximity to the CBD, and limited land supply. These suit investors focussed on long-term appreciation.

Typical rental yields: 3.0-4.0%

Regional WA

Towns: Geraldton, Bunbury, Busselton, Albany, Kalgoorlie

Regional WA towns tied to mining, agriculture, or tourism can offer yields of 5-7%+ for investors willing to accept higher risk and lower liquidity. We conduct extensive due diligence on economic drivers, vacancy rates, and employment diversity before recommending regional purchases.

Typical rental yields: 5.0-7.0%+

Every investor has different goals. Some want high cash flow in outer suburbs, others want long-term capital growth in established areas. We match your investment strategy to the right Perth location—not the other way around.

Our Perth Buyers Agency Process

We don’t believe in cookie-cutter property investing. Every client gets a personalised, data-driven strategy based on their financial position, risk tolerance, and investment goals.

Discovery Call & Strategy Session

We start with a free 30-45 minute discovery call to understand your situation. What's your budget? What's your borrowing capacity? Are you chasing cash flow or growth? Do you want Perth metro or regional WA? Once we've established your goals, we create a tailored property investment Perth strategy.

Market Research & Suburb Selection

We analyse dozens of Perth suburbs using population growth data, rental yield statistics, vacancy rates, infrastructure pipelines, and economic fundamentals. We shortlist 3-5 suburbs that align with your strategy and present our findings with full transparency.

Property Search (On-Market & Off-Market)

This is where our Perth agent network becomes invaluable. We search on-market listings, but more importantly, we tap into off-market property deals that never hit realestate.com.au. We inspect properties on your behalf, conduct initial due diligence, and send you detailed reports with photos, videos, and analysis.

Due Diligence & Property Analysis

Before you commit a cent, we conduct forensic-level due diligence: building and pest inspections, strata reports (if applicable), title searches, rental appraisals, comparable sales analysis, and cash flow modelling. You get a full investment analysis report showing projected returns over 5, 10, and 20 years.

Negotiation & Offer

We negotiate on your behalf to secure the property below market value. On average, our clients save $20,000-$50,000 compared to what they would have paid buying directly. We handle all communication with selling agents, present offers strategically, and manage the back-and-forth until we reach the best possible price.

Contract to Settlement

Once your offer is accepted, we coordinate with your conveyancer, lender, and building inspector to ensure a smooth settlement. We review contracts, manage conditions (building and pest, finance, etc.), and stay involved right through to the day you officially own the property.

From start to finish, the process typically takes 4-12 weeks depending on your readiness, finance approval time, and property availability. We keep you informed every step of the way.

Who Uses Our Perth Buyers Advocate Service?

Our clients come from all walks of life, but they share one thing in common: they’re serious about building wealth through investment property in Perth and don’t have time to do it alone.

Time-Poor Professionals

Doctors, engineers, executives, and business owners who earn strong incomes but don't have weekends free to attend open homes. They want someone to handle the entire process while they focus on their careers.

First-Time Investors

People buying their first investment property who don't want to make expensive mistakes. They need education, guidance, and confidence that they're buying the right property in the right location for the right price.

Experienced Portfolio Builders

Investors with 3-10+ properties who want to expand into Perth or add WA diversification to their portfolio. They understand the value of a buyers agent in Perth and want access to off-market deals they can't find themselves.

Interstate and Overseas Investors

Sydney, Melbourne, or Brisbane investors who see opportunity in Perth but don't have local market knowledge. Overseas investors (expats, visa holders) who want Australian property exposure but can't be on the ground.

SMSF and Trust Buyers

Investors purchasing through self-managed super funds, family trusts, or company structures who need a buyers advocate in Perth experienced with complex settlement requirements and compliance.

Renovation and Development Investors

Investors looking for properties with value-add potential—subdivisions, duplexes, granny flats, cosmetic renovations. We identify opportunities where you can manufacture equity through strategic improvements.

No matter which category you fall into, we tailor our service to your needs. Some clients want full hand-holding, others just want us to find the property and negotiate the price. We adapt.

Why Australian Property Experts is Different from Other Perth Buyers Agents

There are plenty of buyers agents operating in Perth. Here’s what makes us different:

100% Investment Property Focus

We don't touch owner-occupier homes. Every property we buy is for investment purposes, which means we're experts in rental yields, cash flow analysis, depreciation schedules, and long-term growth modelling. We're not distracted by lifestyle features or emotional purchases.

Zero Conflicts of Interest

We don't accept developer commissions, rebates, or kickbacks. We're not tied to any builders, project marketers, or selling agents. Our only incentive is to find you the best property at the lowest price, whether that's a 30-year-old house in Baldivis or a brand-new townhouse in Alkimos.

Transparent Flat Fee Structure

Our fee is $8,000-$16,000+ depending on purchase price and complexity. No hidden costs, no percentage-based fees that incentivise us to push you into more expensive properties. You know exactly what you're paying upfront.

Off-Market Access

We've built relationships with dozens of Perth real estate agents over the years. They call us first when a good investment property is about to list, or when a vendor wants a quiet, off-market sale. This gives you a competitive advantage over DIY buyers scrolling realestate.com.au.

Data-Driven, Not Gut-Driven

Peter's background in banking and financial analysis means every recommendation is backed by data. We don't rely on "gut feel" or anecdotal evidence. We use population growth trends, median price movements, rental yield comparisons, and economic forecasts to guide decisions.

Australia-Wide Buying Experience

We're not just Perth buyers agents. We buy properties across Sydney, Brisbane, Adelaide, Melbourne, and regional Australia. This gives us a national perspective on market cycles, relative value, and diversification opportunities that local-only agents don't have.

Peter Owns 16+ Investment Properties Himself

Peter isn't a property buyer who's never invested himself. He owns 16+ personal investment properties and has lived through multiple market cycles. When he recommends a strategy, it's because he's used it himself and knows it works.

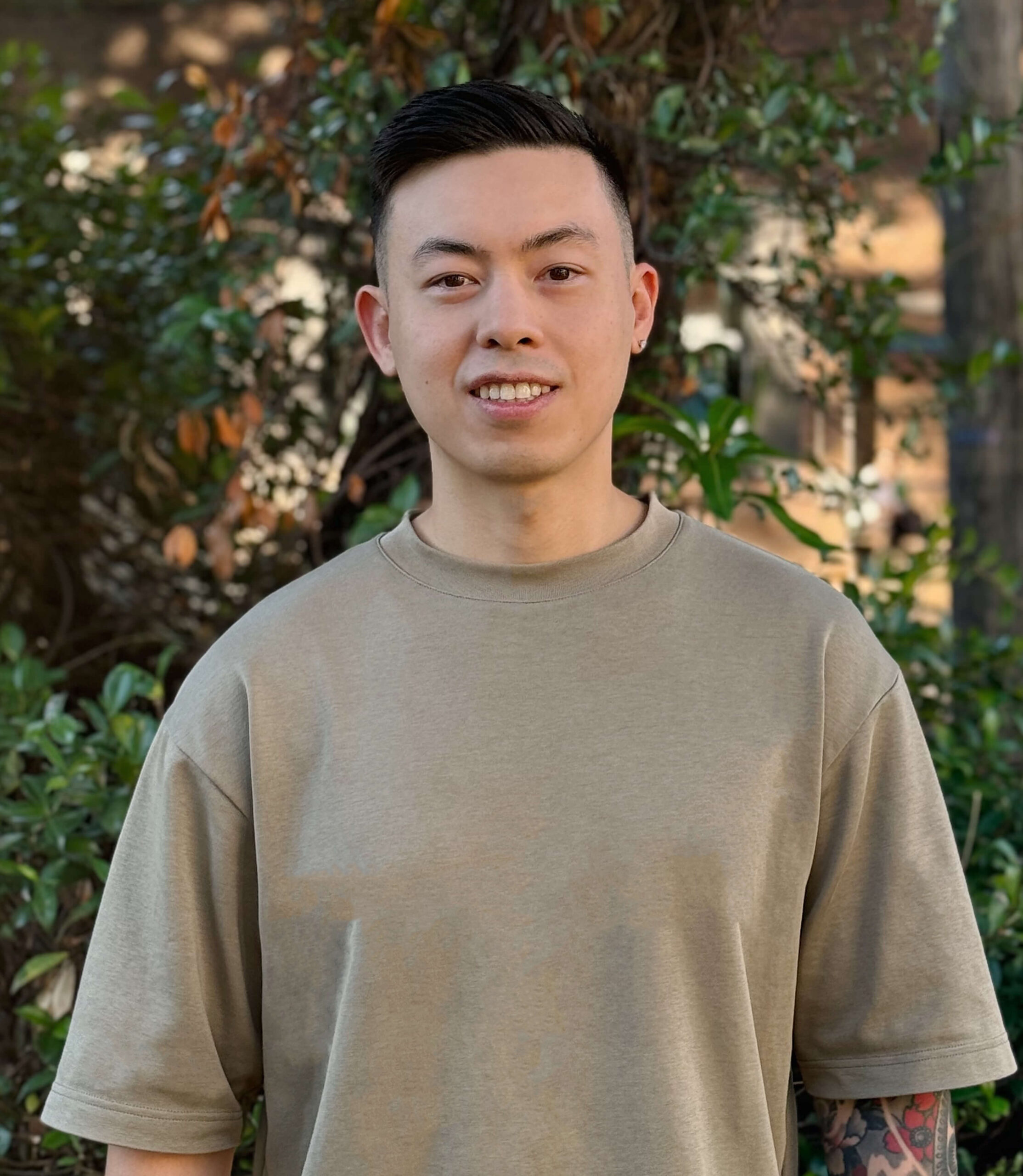

Meet Peter Ly – Perth-Focused Buyers Agent Based in Sydney

Peter Ly is the founder of Australian Property Experts and one of Australia’s most experienced investment property buyers agents. While based in Parramatta, Sydney, Peter has purchased dozens of properties for clients across Perth and regional Western Australia.

- Background: Former banker and financial analyst with an accounting background. Peter understands property from a numbers perspective—cash flow, serviceability, tax implications, and portfolio structuring.

- Personal Portfolio: Peter owns 16+ investment properties across Australia, including holdings in Sydney, Brisbane, and regional markets. He's not just a buyer—he's an active investor who uses the same strategies he recommends to clients.

- Experience: Over the past decade, Peter has purchased 200+ investment properties for clients, with a focus on below-market-value deals, off-market opportunities, and data-driven suburb selection.

- License: Fully licensed (License No. 4769472), insured, and operates with complete transparency. No developer commissions, no rebates, no conflicts of interest.

Peter’s approach is simple: treat every client’s purchase as if it were his own money. That means rigorous due diligence, aggressive negotiation, and absolute honesty about risks and opportunities.

If you want to work with someone who’s genuinely invested in your success, Peter is the Perth buyers advocate you’ve been looking for.

Ready to Buy Your Next Investment Property in Perth?

Whether you’re a first-time investor looking to break into the Perth market or an experienced portfolio builder wanting to add WA diversification, we’re here to help.

Here's what happens next:

1. Book a free 30-45 minute discovery call via our Calendly link. We’ll discuss your goals, budget, and investment strategy. No sales pitch, no pressure—just honest advice about whether Perth is right for you.

2. If we’re a good fit, we’ll create a tailored property search brief based on your criteria. We’ll shortlist suburbs, set search parameters, and start hunting for on-market and off-market properties.

3. We’ll present properties with full analysis—photos, videos, rental appraisals, comparable sales, cash flow projections, and risk assessments. You make the final decision, but we give you all the information you need to decide confidently.

4. Once you’re ready to buy, we negotiate on your behalf to secure the property below market value, then manage the entire process through to settlement.

Within 4-12 weeks, you could own a high-performing investment property in Perth that generates strong cash flow, builds equity, and sets you up for long-term wealth creation.

Don’t waste time scrolling through property portals or attending open homes every weekend. Let us do the heavy lifting while you focus on your career, family, and life.

Book a free discovery call with Peter to discuss your investment goals, or call directly on 0468 886 683 for immediate advice.

Our Results Speak for Themselves

Recent Deals

26.7% growth in 10 months (WA)

This 4 bed 1 bath double-brick house in WA boasts a rental yield of 8.1%. We purchased this one under market value for $355,000 in June 2023, and it has since seen an unbelievable 35.2% growth to $480,000 in just 10 months.

41.8% growth in 18 months (WA)

This beautiful house in Perth, less than 5 minutes to the beach, was purchased for $398,900 in June 2022. It has since seen 50.4% growth to $600,000 in 18 months and has seen its rental yield grow from 5.5% at purchase to now 7.2%.

35% growth in 21 months (QLD)

This brick Queensland house was purchased only 21 months ago for $422,000, and has since grown 37.4% to $580,000, resulting in capital growth of $158,000 and cash on cash return of 234%. Rent has also grown steadily and is now returning a strong rental yield of 6.28%.

27.2% growth in 14 months (QLD)

This regional Queensland house with strong rental yield of 6.27%, has grown a whopping $124,000 to $580,000 in just over one year since it was purchased for $456,000, resulting in an impressive cash on cash return of 170%.

76.7% growth in 26 months (WA)

We purchased this brick house in Perth on a massive 819sqm block of land, just 20km from the Perth CBD, for $339,500 back in February 2022. It has since seen remarkable growth of 76.7% growth to $600,000 in 26 months. Rental yield is now sitting at a jaw dropping 8.42%.

32.6% growth in 26 months (Adelaide)

This renovated brick house, 31km from Adelaide CBD and just minutes to the beach, was purchased in February 2022 for $460,000. In 26 months, it has grown 32.6% in value to $610,000, resulting in a cash on cash return of 204%. Rental yield is sitting at a solid 5.65%.

Book Your Free Strategy Call

Learn More

Buyers Agent Perth: Frequently Asked Questions

Our buyers agency fees range from $8,000 to $16,000+ depending on the purchase price, property type, and complexity of the transaction. This is a flat fee—not a percentage—which means we’re never incentivised to push you into a more expensive property just to increase our commission.

Compared to the $20,000-$50,000 most investors save through better negotiation and off-market access, our fee typically pays for itself several times over. We’re also transparent about costs upfront—no hidden fees, no surprises.

We only work with property investors. We don’t buy owner-occupier homes, which means we’re 100% focussed on investment fundamentals: rental yield, capital growth potential, cash flow analysis, and portfolio strategy. If you’re looking to buy your dream home in Perth, we’re not the right fit. But if you’re building wealth through investment property, we’re experts.

We buy investment property across greater Perth (north, south, east, and inner suburbs) plus regional Western Australia including Geraldton, Bunbury, Busselton, Albany, and Kalgoorlie. We focus on suburbs and towns with strong fundamentals—employment diversity, population growth, rental demand, and infrastructure investment.

We don’t limit ourselves to one area. Instead, we match your investment goals and budget to the best-performing locations across WA, whether that’s a high-yield property in Mandurah or a growth-focussed house in Yanchep.

Absolutely. In fact, most of our clients are interstate or overseas investors who don’t have time to fly to Perth for inspections and auctions. We handle everything remotely: property searches, inspections, negotiations, and settlement coordination. You’ll receive detailed reports, photos, videos, and analysis for every property we recommend, so you can make informed decisions from anywhere in the world.

We’ve built strong relationships with Perth real estate agents over the years. They know we’re serious buyers who can settle quickly, which means they call us first when a good investment property is about to list or when a vendor wants a quiet sale. Off-market and pre-market properties often sell for 5-10% below what they’d achieve in a public campaign, giving our clients a significant advantage.

We charge a flat fee ($8,000-$16,000+), not a percentage of the purchase price. This structure ensures we’re never incentivised to push you into a more expensive property just to earn a bigger commission. Our only goal is to find the best investment property for your strategy at the lowest possible price.

There’s no practical difference—buyers agent and buyers advocate are two terms for the same thing. Both refer to a licensed professional who represents property buyers (not sellers) and helps them find, negotiate, and purchase property. We use both terms interchangeably, and you’ll see “property buyers agent Perth” and “buyers advocate Perth” used throughout our website.

From initial strategy call to settlement, the process typically takes 4-12 weeks. The timeline depends on several factors: how quickly you can arrange finance pre-approval, how active the Perth market is, whether we find a suitable property on-market or off-market, and how long the settlement period is. We keep you informed at every stage and work as quickly or slowly as you prefer.

No. Zero. Never. We don’t accept developer commissions, rebates, kickbacks, or any form of payment from third parties. Our only income is the flat fee you pay us, which means we have zero conflicts of interest. If a developer’s property is genuinely the best fit for your strategy, we’ll recommend it. But we’re not incentivised to steer you toward new builds or off-the-plan properties just because someone’s paying us a commission.

Yes, we regularly assist clients purchasing investment property through self-managed super funds (SMSFs). SMSF purchases have additional compliance requirements—sole purpose test, arm’s length transactions, borrowing restrictions (if using limited recourse borrowing arrangements)—and we’re experienced in navigating these complexities. We work closely with your accountant and SMSF administrator to ensure everything is structured correctly.