Buyers Agent QLD – Investment Property Specialists

Queensland-wide buyers agency service with off-market access, zero conflicts, and 200+ successful purchases for investors

Leave it to the Experts

Looking for a buyers agent in Queensland who actually specialises in investment property?

We’re Australian Property Experts – a Sydney-based buyers agency that buys investment properties across Queensland and Australia-wide for time-poor investors who want straight talk, not sales pitch.

Here’s the difference: we don’t touch owner-occupier homes. We only buy investment property. That means every market we analyse, every property we inspect, and every negotiation we conduct is purely focused on cash flow and capital growth – not emotional decisions about kitchen benchtops.

Our founder Peter Ly owns 16+ investment properties personally and has purchased 200+ properties for clients across Queensland, NSW, SA, WA, and VIC. We have no developer deals, no rebate arrangements, and no reason to push you toward properties that don’t stack up.

Why Use a Buyers Agent in Queensland?

Queensland’s property market is massive and fragmented. From Brisbane’s booming inner suburbs to regional growth hubs like Townsville, Rockhampton, and Toowoomba, finding the right investment property takes serious time and local knowledge.

Most investors we work with are time-poor professionals – doctors, engineers, business owners – who don’t have weeks to drive around inspecting properties or analyzing suburb data. They need someone who can cut through the noise and find genuine opportunities.

What a Queensland Buyers Advocate Does for You:

Market research and suburb selection

We analyse cash flow, capital growth potential, rental yields, vacancy rates, and infrastructure projects

Off-market property access

Through our agent network, we see properties before they hit the market

Property inspections

We inspect on your behalf (with photos and video) so you don't need to be there

Due diligence

Building and pest, strata reports, council searches, flood checks, rental appraisals

Negotiation

We negotiate to get you below market value pricing, not just "good deals"

Settlement coordination

We manage the entire process from contract to keys

The average time our clients save by using our buyers agency service is 100+ hours per property purchase. That’s time you can spend at work, with family, or building your business instead of chasing real estate agents.

Investment Property Markets We Cover in Queensland

We buy investment property across Queensland with a focus on markets that offer genuine rental demand, capital growth potential, and cash flow viability.

Brisbane and Greater Brisbane

Brisbane’s property market has seen significant growth, driven by interstate migration, infrastructure investment (Cross River Rail, Brisbane Metro), and limited supply. We focus on growth corridors with strong rental demand:

North Brisbane

Petrie, Kallangur, Murrumba Downs, North Lakes

South Brisbane

Logan, Beenleigh, Jimboomba, Park Ridge

West Brisbane

Ipswich, Springfield, Ripley, Redbank

Inner suburbs

Opportunistic purchases only when numbers stack up

Median house prices in Brisbane’s growth corridors typically range from $450,000 to $750,000, with gross rental yields between 4.5% and 6% depending on the property type and location.

Regional Queensland Investment Hotspots

Regional Queensland offers some of Australia’s best cash flow opportunities for investors. These markets have strong employment drivers, affordability, and rental yields that Sydney and Melbourne can’t match.

Townsville

Major defence and mining hub with strong rental demand. Median house price is around $430,000 with gross yields of 5.5-7%. The city benefits from defence contracts, port activity, and population growth.

Rockhampton

Central Queensland's mining service hub. Properties from $350,000-$500,000 with yields up to 6.5%. Strong rental demand from mining workers and the agricultural sector.

Toowoomba

Queensland's largest inland city with a diverse economy. Median house price is around $520,000 with solid yields of 4.5-5.5%. Benefits from the Inland Rail project and agricultural sector.

Bundaberg

Regional coastal city with affordability and growth potential. Properties from $380,000-$550,000 with yields of 5-6%. Growing retiree population and agricultural employment.

We also cover other Queensland regions including Cairns, Mackay, Gladstone, and the Sunshine Coast depending on market conditions and investment criteria.

How We're Different from Other Buyers Agents in Queensland

Most buyers agencies in Queensland will buy anything you want – investment properties, first homes, luxury houses, lifestyle properties. We don’t.

We only buy investment property. That’s it. No emotional purchases, no “forever homes,” no properties that don’t meet our investment criteria.

Our Key Differentiators:

- 100% investment focus – Every property must stack up financially or we won't buy it

- Zero conflicts of interest – No developer commissions, no rebates, no kickbacks from anyone

- Off-market access – We source 60-70% of properties before they're publicly listed

- Experienced investor founder – Peter owns 16+ properties and has purchased 200+ for clients

- Australia-wide coverage – We buy in QLD, NSW, SA, WA, and VIC to find the best opportunities

- Data-driven approach – Former banker and financial analyst with accounting background

- Transparent flat fees – $8,000-$16,000+ depending on scope, no percentage commissions

The biggest problem with percentage-based fees is the conflict of interest. If a buyers advocate charges 2-3% of the purchase price, they earn more when you spend more. That’s backwards.

We charge transparent flat fees so we’re incentivised to negotiate the best possible price for you, not inflate it.

Our Queensland Buyers Agency Process

Here’s exactly how we work when you engage us as your buyers agent in Queensland:

1. Discovery and Strategy Session (Week 1)

We start with an in-depth discussion about your investment goals, budget, timeline, risk tolerance, and portfolio strategy. This isn’t a sales pitch – we’re assessing whether we’re the right fit for each other.

We’ll discuss your borrowing capacity, deposit position, preferred property types, and target cash flow or capital growth outcomes. If investment property in Queensland doesn’t suit your goals, we’ll tell you.

2. Market Research and Suburb Selection (Week 1-2)

We analyse Queensland markets based on your criteria, looking at:

- Historical and projected capital growth rates

- Rental yields and vacancy rates

- Infrastructure projects and economic drivers

- Population growth and demographic trends

- Supply and demand dynamics

- Council development plans

We present you with 2-3 recommended suburbs or regions with detailed analysis and rationale.

3. Property Sourcing and Inspection (Weeks 2-6)

We activate our agent network and start sourcing properties in your target areas. This includes off-market properties, pre-market listings, and occasionally on-market opportunities if they’re genuinely good value.

We inspect properties on your behalf, providing detailed photos, videos, and written reports. You don’t need to be in Queensland to buy here.

4. Due Diligence and Analysis (Ongoing)

For every shortlisted property, we conduct:

- Building and pest inspections

- Strata reports (for units/townhouses)

- Council searches and zoning checks

- Flood and environmental reports

- Rental appraisals from multiple agents

- Comparable sales analysis

We present findings and recommendations. If issues arise, we walk away and keep searching.

5. Negotiation and Purchase (Weeks 4-8)

When we find the right property, we negotiate hard to get you below market value pricing. Our goal is to save you $20,000-$50,000+ through skilled negotiation and market knowledge.

We handle all contract negotiations, cooling-off periods, and conditions. You review and sign when ready.

6. Settlement and Handover (Weeks 8-12)

We coordinate with your solicitor, lender, and the selling agent to ensure smooth settlement. After settlement, we connect you with property managers and help with the handover process.

Total timeline is typically 4-12 weeks from engagement to settlement, depending on market conditions and your approval speed.

Who Uses Our Queensland Buyers Advocate Service?

Our typical clients fall into these categories:

Time-Poor Professionals

Doctors, engineers, lawyers, and executives who earn good money but don't have time to research suburbs, inspect properties, and manage the purchase process. They need someone they can trust to handle everything while they focus on their career.

First-Time Investors

People buying their first investment property who want expert guidance on market selection, property types, cash flow modelling, and tax structuring. They're overwhelmed by the options and need clear direction.

Experienced Portfolio Builders

Investors with 3-10+ properties who want to accelerate their portfolio growth and leverage our off-market access and negotiation skills. They understand the value of a buyers agent and see us as a strategic partner.

Interstate and Overseas Investors

People living in Sydney, Melbourne, or overseas who want to invest in Queensland but can't be here for inspections and auctions. We act as their eyes, ears, and boots on the ground.

SMSF and Trust Buyers

Investors purchasing through self-managed super funds, family trusts, or company structures who need professional guidance on compliance and appropriate property selection.

Renovation and Development Investors

Experienced investors looking for properties with value-add potential through renovations, subdivisions, or dual occupancy development. We can identify these opportunities and connect you with builders and town planners.

What Does a Buyers Agent Cost in Queensland?

Our fees are transparent flat rates based on the scope of service, not percentage commissions.

Typical Fee Structure:

- Full service buyers agency – $8,000-$16,000+ depending on property price and complexity

- Search and negotiate only – $5,000-$8,000 (you provide your own shortlist of suburbs)

- Due diligence and negotiation – $3,000-$5,000 (you've found a property, we assess and negotiate)

- Portfolio strategy session – $500-$1,000 (one-off consultation)

We don’t charge percentage fees because they create the wrong incentives. Our goal is to negotiate the lowest possible price for you, not inflate it to increase our commission.

The return on investment from using a buyers advocate in Queensland typically comes from:

- Purchase price savings – $20,000-$50,000+ below market value through negotiation

- Time savings – 100+ hours you'd spend researching and inspecting properties

- Opportunity cost – You can focus on your career instead of property hunting

- Avoiding mistakes – Not buying overpriced properties or locations with poor fundamentals

- Off-market access – Properties you couldn't access on your own

If we save you $30,000 on a $600,000 property and charge you $12,000 in fees, you’re still $18,000 ahead plus all the time saved.

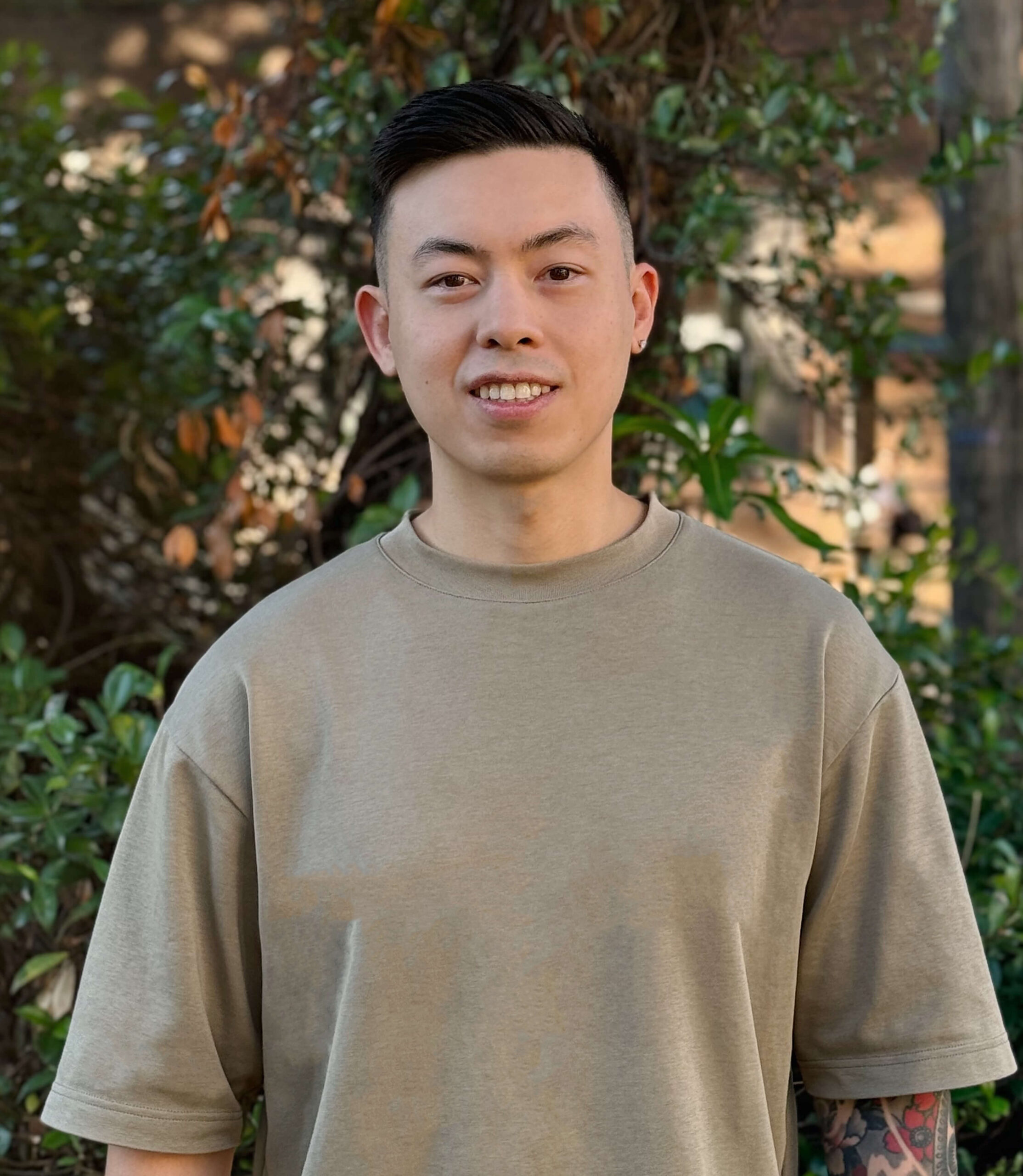

Meet Peter Ly – Your Queensland-Focused Buyers Agent

Peter Ly is the founder of Australian Property Experts and a Queensland buyers agent with serious credentials.

He owns 16+ investment properties personally across Australia and has purchased 200+ properties for clients over his career. Before becoming a buyers advocate, Peter worked as a banker and financial analyst with an accounting background, so he approaches every property purchase with rigorous financial analysis.

Peter’s investment philosophy is simple: numbers first, emotions never.

He won’t recommend a property just because it “feels right” or has nice finishes. Every investment must meet strict criteria for cash flow, capital growth potential, rental demand, and risk-adjusted returns.

Based in Parramatta, Sydney, Peter buys investment property Australia-wide, with Queensland being a major focus due to its affordability, rental yields, and growth potential. He has established relationships with agents, property managers, and industry contacts throughout Brisbane, Townsville, Rockhampton, Toowoomba, and other regional centres.

License Number: 4769472

ABN: 27 631 995 572

Why Work with Peter?

- Active investor – He buys properties with his own money and understands the risks

- No conflicts – Zero commissions from developers or rebates from agents

- Analytical approach – Financial background means rigorous due diligence

- Direct communication – You work with Peter, not junior staff

- Proven track record – 200+ successful purchases for clients

Service Areas: Where We Buy Investment Property in QLD

We cover all of Queensland for investment property purchases, with our primary focus areas including:

South East Queensland

- Greater Brisbane (all corridors)

- Gold Coast (opportunistic)

- Sunshine Coast (opportunistic)

- Logan and surrounds

- Ipswich and growth corridors

- Toowoomba

Regional Queensland

- Townsville

- Rockhampton

- Bundaberg

- Mackay

- Cairns (opportunistic)

- Gladstone

We also buy investment property in NSW, SA, WA, and VIC to give our clients access to the best opportunities nationwide. Sometimes the best investment isn’t in Queensland – we’ll tell you honestly.

As a Buyers Agent Australia-wide, we compare markets across the country to find where your investment dollars will work hardest.

Ready to Buy Your Next Investment Property in Queensland?

If you’re serious about buying investment property in Queensland and want a buyers agent who’ll give you straight talk instead of sales pitch, let’s have a conversation.

We’re not for everyone. If you want someone to tell you every property is “amazing” and push you toward developer stock with hidden commissions, we’re not your people. If you want someone who only buys investment property that meets strict financial criteria and will tell you when something doesn’t stack up, we should talk.

Book a free discovery call with Peter to discuss your investment goals, or call directly on 0468 886 683 for immediate advice.

Our Results Speak for Themselves

Recent Deals

26.7% growth in 10 months (WA)

This 4 bed 1 bath double-brick house in WA boasts a rental yield of 8.1%. We purchased this one under market value for $355,000 in June 2023, and it has since seen an unbelievable 35.2% growth to $480,000 in just 10 months.

41.8% growth in 18 months (WA)

This beautiful house in Perth, less than 5 minutes to the beach, was purchased for $398,900 in June 2022. It has since seen 50.4% growth to $600,000 in 18 months and has seen its rental yield grow from 5.5% at purchase to now 7.2%.

35% growth in 21 months (QLD)

This brick Queensland house was purchased only 21 months ago for $422,000, and has since grown 37.4% to $580,000, resulting in capital growth of $158,000 and cash on cash return of 234%. Rent has also grown steadily and is now returning a strong rental yield of 6.28%.

27.2% growth in 14 months (QLD)

This regional Queensland house with strong rental yield of 6.27%, has grown a whopping $124,000 to $580,000 in just over one year since it was purchased for $456,000, resulting in an impressive cash on cash return of 170%.

76.7% growth in 26 months (WA)

We purchased this brick house in Perth on a massive 819sqm block of land, just 20km from the Perth CBD, for $339,500 back in February 2022. It has since seen remarkable growth of 76.7% growth to $600,000 in 26 months. Rental yield is now sitting at a jaw dropping 8.42%.

32.6% growth in 26 months (Adelaide)

This renovated brick house, 31km from Adelaide CBD and just minutes to the beach, was purchased in February 2022 for $460,000. In 26 months, it has grown 32.6% in value to $610,000, resulting in a cash on cash return of 204%. Rental yield is sitting at a solid 5.65%.

Book Your Free Strategy Call

Learn More

Buyers Agent QLD: Frequently Asked Questions

No. Most of our clients are interstate or overseas investors who never see the property until after settlement. We conduct all inspections on your behalf, provide detailed photo and video reports, and handle the entire purchase process remotely. You can buy investment property in Queensland from anywhere in the world.

It depends entirely on your investment goals, risk tolerance, and budget. Brisbane’s growth corridors offer strong capital growth potential but lower yields. Regional centres like Townsville and Rockhampton offer higher cash flow but slower capital growth. We analyse your situation and recommend markets that align with your strategy – whether that’s cash flow, growth, or a balance of both.

Our fees range from $8,000-$16,000+ for full-service buyers agency work, depending on property price and complexity. We charge transparent flat fees, not percentage commissions, so we’re incentivised to negotiate the lowest price for you. We also offer partial services starting from $3,000 if you only need due diligence and negotiation assistance.

Yes. We work with SMSF trustees and their accountants to identify compliant investment properties in Queensland. SMSF property purchases have specific rules around residential vs commercial, related party transactions, and borrowing arrangements. We ensure any property we recommend meets SMSF compliance requirements and coordinates with your SMSF administrator and solicitor.

From engagement to settlement, the process typically takes 4-12 weeks. Week 1-2 is strategy and market research. Weeks 2-6 is property sourcing and inspections. Weeks 4-8 is negotiation and contract. Weeks 8-12 is settlement. The timeline varies based on market conditions, your approval speed, and whether you’re a cash buyer or need finance approval.

Yes. We source 60-70% of properties off-market through our agent network across Queensland. Off-market properties offer less competition, better negotiation leverage, and access to deals other investors never see. Our relationships with agents in Brisbane, Townsville, Rockhampton, and other centres give us early access to listings before they’re publicly advertised.

There’s no difference – the terms are used interchangeably. Both refer to licensed professionals who represent property buyers. In Queensland, buyers agents must hold a real estate license. Peter Ly holds License Number 4769472. Some people prefer the term “buyers advocate” as it emphasises the advocacy and representation role, but legally and practically, they’re the same thing.

No. We only buy investment property. We don’t purchase first homes, family homes, luxury houses, or any property where the primary purpose is owner-occupation. This specialisation allows us to focus entirely on investment fundamentals – cash flow, capital growth, rental demand, and financial returns – without emotional factors clouding the decision.

Our fees are based on complexity and scope of work, not location. A regional Queensland purchase in Townsville costs the same as a Brisbane purchase at the same price point. In some cases, regional properties are actually simpler to assess due to less complex planning schemes and strata arrangements. We quote fees upfront so there are no surprises.

Yes. We work with experienced investors looking for value-add opportunities through cosmetic renovations, structural renovations, subdivisions, or dual occupancy development. We can identify properties with development potential, connect you with builders and town planners, and assess feasibility. This service is for investors who understand construction and development, not beginners looking for their first reno project.